Ideas can come from anywhere. They pop up in brainstorming sessions, are presented in boardrooms, and wake us up with their potential in the middle of the night. The issue is not quantity; the real struggle is weeding out the bad ideas from the good before you invest time and resources.

History shows that’s trickier than it seems. Only 6% of “official” ideas and 14% of promising ideas that reach a development phase become commercial successes. Most marketing, creative, and product teams have experienced the pain of selecting a direction that just doesn’t quite land in the market.

The good news is that research can help solve this problem. Testing ideas early in the process can validate which products and campaigns will ultimately perform with a target audience. The right kind of research can help you both identify winners and continually refine your most promising ideas to keep them on track.

But how do you insert research into your development process without impacting rigid timelines? Can teams afford the cost of reaching niche audiences? And do companies have the research expertise to accurately pinpoint which ideas will pay off?

Early-stage research has been hard to swing both from a timing and cost standpoint. Agencies are slow and expensive, and qualitative methods only provide insights from a few people. Existing methodologies often deliver results that are difficult to interpret. These approaches can quickly bog down even the most nimble teams and agile development efforts. And then there’s the added challenge of finding enough of a sample to test each element. But starting today, teams have a new way to launch this type of research without disrupting or delaying the process.

Idea screening: Uncover winning ideas, fast

Our Idea Screening solution is a new way of validating multiple concepts early in the development cycle; it’s also the fastest way to determine how early-stage ideas will land with your target audience. With Idea Screening, you can test up to 20 ideas in a single study and quickly get results in a presentation-ready format; sometimes in as little as an hour.

It’s ideal for product development, marketing, and creative teams, where ideas go from concept to completion on a predetermined path. Inserting Idea Screening early in the concepting stage can save teams time on revisions and re-dos later in the process, when changes are costly and disruptive.

Idea screening is complementary to Concept Testing, which is designed for more specific testing once ideas are more fully developed. Concept testing would be used to vet elements like packaging, logos, ads or messaging later in the process.

A cost-effective research approach

Idea Screening is based on the sequential monadic methodology; a proven approach that requires a smaller sample than other methods. It allows you to test multiple ideas in any format—text, video, or image—all in the same study.

For example, let’s say you needed to vet 10 different campaign ideas, with a goal of narrowing it down to the top three concepts that would ultimately become fully produced ads. With a monadic study, you’d need 200 responses for each of the 10 concepts, for a total of 2,000 responses.

With a sequential monadic study, each respondent would see a subset of 4 ads, so you would only need a sample size of 500 hundred to get 200 responses per add. That’s a big savings in terms of panel costs, and a much faster study to field.

We once worked with a major CPG client that produced 20 rough, animated cuts of commercials for a TV campaign. Each version highlighted different benefits and even used different actors. The company was overwhelmed with options and needed to decide on the one commercial to send on to the networks. It did some sequential monadic testing with us to screen the ideas and narrow it down to the top five, which were fully produced by its agency and moved to the next stage of research, copy testing.

At the time, SurveyMonkey didn’t have the purpose-built Idea Screening solution, so creating a scorecard that summarized all 20 cuts was a pretty taxing, manual process. (Even then, you can imagine how much the company saved in production costs by getting a quick check early on.) Now, with Idea Screening, conducting this type of early research would be exponentially faster, more cost-effective, and would automatically uncover the most important insights.

Get your study up and running quickly

Delaying a product or creative project with a research cycle is a hard sell for most teams. That’s why we’ve made it fast and easy to launch a study without disrupting the development or creative process.

You can deploy a study in a matter of hours and collect results in as little as an hour. Using our guided self-service setup and a default study design will give you a leg up. Select from a standard set of attributes, such as Overall appeal, Believable, Unique, Meets your needs, or Purchase Intent, or add custom attributes to test multiple stimuli.

Finding the right sample is easy, even for niche or hard-to-reach audiences, using our integrated panel. Tap into 335M+ people in 130+ countries including B2B or B2C audiences.

Harness AI insights and automated analysis

Once you launch a study is typically where the work begins. Analyzing results that include multiple stimuli, attributes, and audiences can be an overwhelming task, especially for fast-moving projects or for teams that don’t have deep research expertise.

This is when Idea Screening does the heavy lifting. It surfaces the actionable insights in your data, leveraging our AI-based methodology and eliminating manual data filtering and analysis.

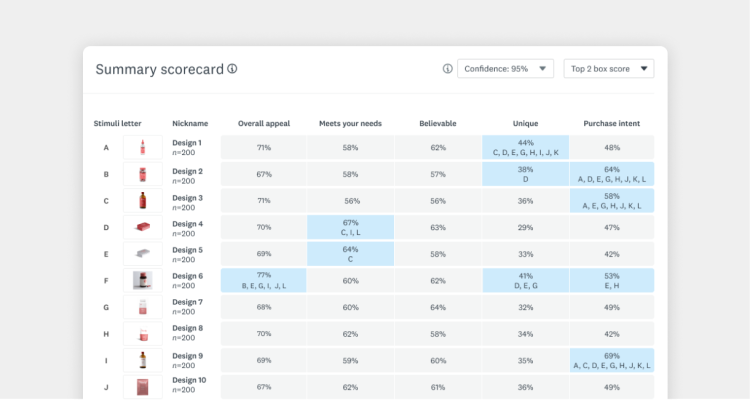

Insights are delivered in easy-to-read scorecards that highlight statistically-significant results. You’ll see at a glance how your ideas stack up based on your chosen attributes. Dive deeper into the data with a unique algorithm that analyzes your results against hundreds of demographic combinations so you can quickly see which ideas each demographic segment preferred.

Word clouds, crosstab reports, filters, and presentation-ready deliverables offer users both high-level and detailed insights even with a limited sample size.

But will they buy it?

The ultimate test of any product or marketing initiative is if it sells, literally or conceptually. That’s why we built in Key Driver Analysis, which clearly indicates which attributes will actually drive purchases, so you know what to invest in and what won’t move the needle. This helps to identify areas of opportunity and improvement, and gives you confidence that the products, creative, and campaigns you build will make a greater impact.

Get started testing your ideas

Whether you’re just starting a new project or in the middle of it, it's not too late to research your top ideas. We’ve developed a family of market research solutions to meet the needs of marketing, product development and insights teams at all stages of the development process.

Learn more about Idea Screening, or explore all our market research solutions.