Private label brands gain traction during the pandemic

Compared to before the pandemic, most consumers are spending at least the same amount on their purchases today. Only 28% are spending less, while 34% are spending more, and 37% are spending the same amount as before Covid.

- Nearly half (45%) of consumers 18-24 are spending more, and those with a higher annual income (100k+) are holding back, with 43% spending about the same amount, and only 28% spending more.

The types of products consumers are buying are also changing, as nearly a quarter (24%) say they have been spending more on private labels than on name brands throughout the pandemic. Among those who are spending more on private-label brands:

- Price and availability are the driving factors influencing their purchasing decisions, with more than half (55%) citing price and one in six (16%) citing availability as their main reasons for gravitating toward private labels.

- This behavior may persist: 52% of those who say they spend more on private label products plan to continue doing so after the pandemic subsides, while nearly a third (32%) are unsure.

Consumers not particularly loyal to either name brands or private labels

When deciding between what brands to purchase, most consumers (59%) look to quality as the determining factor in their decisions, followed by price (25%). In the eyes of consumers, however, quality doesn’t solely belong to either name brands or private labels.

- Most (75%) believe that private labels are “sometimes” similar or better in quality than name brands, at lower prices

- The vast majority of consumers say name-brand products are “sometimes” (69%) or “always” (14%) higher-quality than private label products; just 13% say they are “rarely” and 2% say they are “never” of higher quality

Consumers are noticeably open to purchasing private labels, with only a small minority firm on purchasing name brands over private-label counterparts.

- Only 16% of consumers say they prefer to buy name-brand products if possible, and the vast majority (74%) compare both private-label and name-brand versions before purchasing.

- Less than 1 in 10 (7%) say it is very important for them to purchase name-brand products, and only an additional 1 in 3 (31%) say it is somewhat important. The remaining majority (61%) find it not so important or not important at all

- Very few (10%) strongly agree that name brands guarantee a high quality product, and an overwhelming majority (89%) agree that private labels are a good alternative to name brands

- Private labels are also not only for those on a budget: a mere 10% strongly agree that private labels are only for people who cannot afford name brands

Private labels can be highly recognizable, especially those from larger retailers

Brand recognition may no longer be an advantage of name brands: some private labels are recognized by a large bulk of consumers:

- At least half of all consumers are familiar with Great Value (60%), CVS Health (55%), Trader Joe’s (51%), Kirkland Signature (50%), and Kroger (50%), followed by Aldi (44%), AmazonBasics (39%), Member’s Mark (29%), and 365 Whole Foods Market (27%)

- Private labels from Target, however, have low levels of awareness from consumers, with only 11% familiar with Up&Up, 8% with Good & Gather, and 5% with Smartly.

Private Label Brand Awareness

% Aware

Consumers are not only familiar with these brands, they are also shopping there. Among those aware of each respective brand:

- Nearly half (47%) have made a purchase at Great Value within the last year.

- Roughly a third purchased CVS Health (37%), Kirkland Signature (34%), or Kroger (31%).

- About a quarter purchased from Aldi (28%), AmazonBasics (26%), and Trader Joe’s (25%).

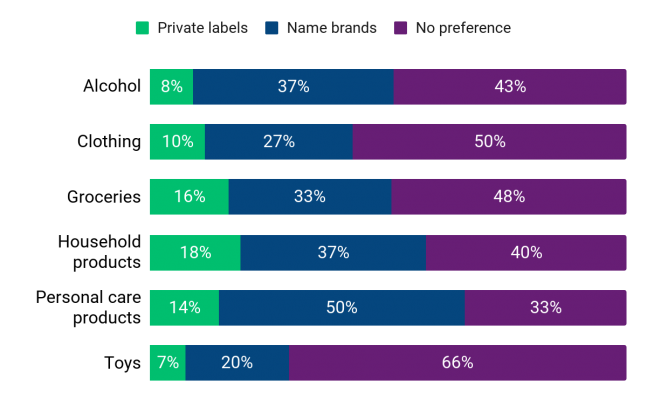

Consumers generally indifferent when it comes to purchasing different types of products

More often than not, consumers have no preference for either private labels or name brands when it comes to specific types of products.

- Personal care products are the sole category where consumers who prefer name brand products outnumber those who have no preference.

- The vast majority (66%) are indifferent when it comes to toys.

- Private labels perform strongest among household products, where nearly 1 in 5 (18%) consumers prefer private labels over name brands.

Private Label vs. Name Brand Preference by Category

Read more about our polling methodology here.