How to use product development surveys for customer satisfaction

Gather valuable consumer feedback with surveys during the product development process to go to market with confidence.

- A product development survey gathers consumer feedback to guide the creation or improvement of a product or service.

- Surveys for product development are used to test concepts, refine features, and validate ideas to ensure market alignment and customer satisfaction.

- Surveys provide valuable insights into consumer preferences, helping refine products and increase market success.

Sixty-one percent of product marketers believe strengthening customer relationships is their company’s top priority. Product development surveys are valuable for gathering customer feedback, enhancing product design, and improving customer satisfaction.

In this guide, we will share how to collect product feedback and use it to develop crowd-pleasing products.

What are surveys for product development?

A product development survey, also known as a product management survey, is a research tool used to gather consumer feedback on a product or service in development.

Product development surveys are valuable for identifying enhancements to existing products or gauging consumer reactions to new product concepts. Feedback from product development surveys can shape product design, speed up development, and improve the final product.

How can surveys help with product development?

Product managers, marketers, and researchers can use surveys to reach various audiences, including current, past, and prospective customers. With product development surveys, professionals can:

- Gather general market research. Product development surveys are useful for gathering demographic data on your ideal customers, such as age and socioeconomic status.

- Screen ideas. Surveys are also valuable for screening new ideas, assessing market viability, and determining demand before investing in product development.

- Test new concepts. Test design concepts or ad creatives with surveys to determine which option will perform better.

- Improve products in development. Surveys for product development provide insight that helps you tailor the new product and its features.

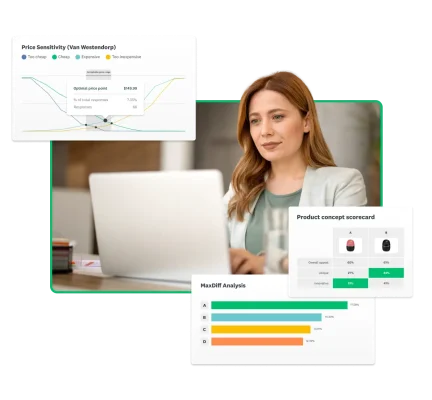

Surveys for product development are versatile and yield actionable, quantifiable data that you can benchmark and track. They are easy to use and quick to deploy, especially when you use survey templates. Check out our survey solutions for product marketers.

Product feedback survey templates and example questions

Marketing surveys are a tool to support your product development research. SurveyMonkey offers templates and sample questions for product feedback.

General market research

General market research collects broad data on a target market, purchasing behaviors, and competitors. This insight aids businesses in reaching their goals by giving them a clear understanding of their customers.

The following general market research surveys can help you better understand your customer:

- Product-market fit. Product-market fit surveys help you identify your product's target demographic and the features your customers want.

- Price testing. This survey assesses what customers are willing to pay for similar products, helping you determine a fair price point.

- Competitor research. Keeping track of your competitors is essential for understanding how to target your ideal customers better. With competitor research surveys, you can explore how consumers view your offerings compared to your competitors.

- Online shopping attitudes. Assess how frequently your target customers shop online and their comfort with privacy features. Use these insights to evaluate their security concerns with online transactions and adjust your rollout strategy accordingly.

You can customize a Market Research Survey Template like the ones above to also ask your target market questions like:

- Which of the following are reasons that you might purchase this product?

- If this product were available today, how likely would you be to choose it over current competing products?

Idea screening

Idea screening helps product development and marketing teams validate products, messages, and ad creatives. It involves presenting multiple concepts to your audience to determine their preferences. This can include prototypes, ad creatives, packaging design, or early-stage products.

Idea screening surveys can help you:

- Identify winning ideas. Identify the most appealing concepts for your target demographic to determine which ideas to advance and which to discard. This ensures the development of products that resonate with customers.

- Iterate on product design. Based on idea screening, you may refine your product design to better align with your target audience’s preferences.

The Messaging/Claims Testing Survey Template allows you to ask your ideal customers questions like:

- Thinking about the claim overall, which of the following best describes your feelings about it?

- Does the claim provide too much information, too little information, or the right amount of information?

Concept testing

Concept testing, similar to idea screening, seeks feedback on more developed concepts rather than new ideas. Testing single or multiple concepts through A/B tests helps avoid mistakes and creates products that fulfill customer desires.

Customize a Product Testing Survey Template to ask questions like:

- When you think about the product, do you think of it as something you need or something you don’t need?

- What is your first reaction to the product?

- How innovative is the product?

Feature development and improvement

Feature development and improvement surveys gather customer feedback to gain valuable insights into feature ideas and identify bugs that need fixing.

Consider working with your customer service team to identify product issues or suggestions. Collaborate on adding a question or two for product development into an existing customer service survey. Read more about customer service surveys in The ultimate guide to customer service.

If your product is software or an app, you can use a Software Evaluation Survey Template to ask questions like:

- How satisfied are you with the security of this software?

- How satisfied are you with the account setup experience of this software?

- How likely is it that you would recommend this software to a friend or family member?

How to write good product feedback surveys

When it comes to product feedback surveys, the better your survey, the more reliable the results. To write good survey questions for product development, keep them short to minimize bias and promote higher engagement rates. Here’s how:

Set a goal for your product development survey

Setting a goal for your survey is necessary to refine the scope of the survey and gather actionable insights. Here are tips for defining your goal:

- Test a few specific concepts. Test several product ideas, new features, etc., and ask respondents to choose a favorite. You could present concepts using simple descriptions, mockups, or semi-detailed overviews.

- Choose one or two specific product aspects. Choose a couple of aspects to improve, asking questions like, “What would make this feature more intuitive?” or “Is this feature too complex, not complex enough, or just right?”

- Solve a specific business problem. Answer questions like “Why are customers dropping our service after only a few months?” by sending a survey.

- Demystify a particular customer problem. If you run a video conferencing company, you might ask, “What aspects of video conferencing contribute to less focused meetings?” Your findings might include “background noise,” prompting your team to introduce a mute button.

Focused investigations can quickly give you a clear path forward. Surveys with broad questions like “Do you like this?” often yield vague, unhelpful responses that don’t improve your understanding. Outline clear goals to focus your survey questions and identify areas of improvement.

Ask the right questions in the right way

Asking the right questions is crucial for obtaining the feedback needed to improve your products. Your survey questions should correlate with your goal.

For example, your goal might be to identify a package design that appeals to customers. In this case, product survey questions about purchasing habits and behaviors may not be appropriate.

Here are a few tips to help you ask the right questions:

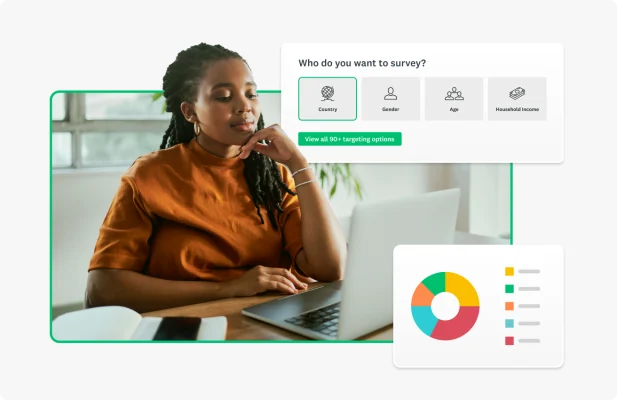

- Identify your audience to tailor your survey. Align your survey language to your target audience’s communication style.

- Include filtering questions for later analysis. Filtering questions disqualifies respondents who are not part of your target audience and may skew results.

- Don’t use jargon. Industry language may confuse respondents. Instead, use clear descriptions and known market names.

- Avoid bias. Give respondents the chance to use their own words with an “Other” option or comment box.

- Keep your survey brief. Ideally, your survey should have 10 or fewer questions.

Tailor your survey to your audience

To ensure accurate survey results, it's crucial to tailor your approach to your target audience. Here are key strategies for creating a successful survey:

- Segment your audience. Segmenting your audience allows for more precise targeting and deeper insights. Tools like SurveyMonkey Audience help you gather data specific to each segment. This includes potential customers, upsell-ready customers, certain age groups, and full-time employees.

- Avoid jargon. Use clear, straightforward language to prevent confusion and ensure respondents fully understand the questions.

- Choose the right medium. Deliver your survey through channels your audience frequently uses. This could be email, social media, or your business website.

Rely on customizable questions and templates

When time is limited, creating product development surveys from scratch may not be feasible. SurveyMonkey offers Product Development Survey Templates to streamline the process of gathering customer feedback, aiding in refining your concepts.

If you're uncertain where to begin, the SurveyMonkey Question Bank offers hundreds of pre-written questions. These questions can help you efficiently craft effective surveys.

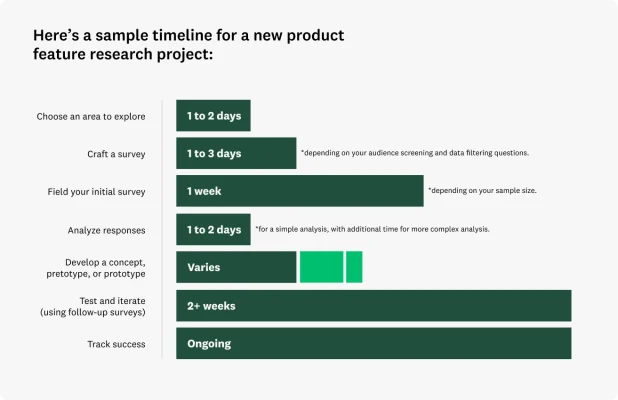

When to fit surveys into your product development cycle

Knowing when to incorporate surveys into your product development cycle is crucial. Key moments include:

- Planning new features or products. Surveys are valuable when collaborating with product teams to plan a product roadmap or prioritize new features.

- Validating big ideas or concepts. Before investing resources, use surveys to validate new concepts.

- Post-collaboration feedback. After working with stakeholders, surveys can address specific insights or questions about your products and features.

- Responding to usage declines. If you notice a drop in product usage, purchases, or repeat customers, surveys can help identify the cause.

- Gaining competitive insights. Competitive differentiation surveys can further refine your understanding of customer preferences.

How to analyze survey feedback and take action

Analyzing survey feedback is as crucial as setting goals and crafting the survey.

Helix Sleep, a mattress company, used SurveyMonkey’s product development solution for concept testing. It leveraged SurveyMonkey Audience to understand the sleeping habits of its target audience.

Helix Sleep used research to develop the Helix Pillow, ensuring it met their target market's needs and price point. They found that 40% of consumers buy pillows with mattresses, highlighting key market segments to target.

Like Helix Pillow, your analysis can yield actionable steps to aid your product development. Consider the following tips before analyzing your data.

- Weight your surveys. Weighting surveys for market research adjusts your sample to better reflect the broader consumer population of interest.

- Clean your data. Exclude incomplete responses and those that don't meet your target criteria to avoid skewed results. Also, remove "straightliners" as they may not provide reliable feedback.

- Use filters. Filters refine raw data, allowing a deeper analysis of specific aspects. You can filter by question, answer, or completeness to view complete responses.

- Apply compare rules. Compare rules allow you to select and view multiple answer options from a single question side-by-side. This feature helps analyze responses across different age groups.

- Create tags. Use tags to categorize open-ended responses by creating rule-based tags or manually tagging.

- Leverage Sentiment Analysis. Sentiment Analysis organize text responses to reveal underlying emotions, applicable to all open-ended text except Multiple Textboxes.

Get started with SurveyMonkey for product teams

Make your product launch a success! Product development surveys are a vital research tool for successful product development. They help identify winning ideas and determine which features to prioritize on your product roadmap.

SurveyMonkey offers solutions for product teams that empower your team to design better products. Sign up today to start creating surveys.

NPS®, Net Promoter® & Net Promoter® Score are registered trademarks of Satmetrix Systems, Inc., Bain & Company and Fred Reichheld.

Ready to get started?

Discover more resources

Understand your target market to fuel explosive brand growth

Brand marketing managers can use this toolkit to understand your target audience, grow your brand, and prove ROI.

Customer Behavior Analysis: A Complete Guide and Examples

Read our step-by-step guide on conducting customer behavior analysis. Learn how to collect data and improve customer touchpoints.

Survey Analysis Report: How to Create, Tips & Examples

Presenting your research soon? Learn the most effective way to use a survey analysis report. See sections to include and report best practices.

What is agile market research and how to use it

Conduct market research faster for real-time insights and smart decision-making. Learn what agile market research is and how to apply the framework.